Double Taxation: How MLI Applied in Kazakhstan?

November 23, 2021

The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (also known as MLI) is effective in Kazakhstan from 1 January 2021. Prior its effective date, double taxation issues were regulated by the relevant Double Taxation Treaties (hereinafter - DTT). Now, when setting the taxable base and the double taxation avoidance, the relevant DTTs to be considered along with the provisions of the MLI.

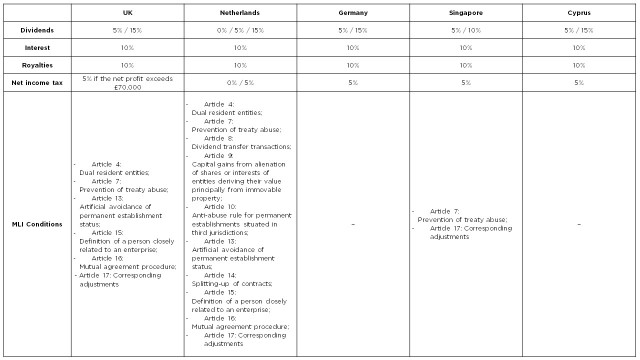

We have reviewed five most popular jurisdictions for structuring: UK, Netherlands, Germany, Singapore and Cyprus. All of these countries have ratified the MLI, but not all of them fully apply its provisions in their relation to Kazakhstan, e.g.:

· MLI is fully applied between Kazakhstan and the Netherlands;

· Partially MLI provisions are applied between Kazakhstan and UK/Singapore;

· Germany and Cyprus do not apply the MLI in their relations with Kazakhstan.

For your convenience, we have prepared summary table on the applicable tax rates to the main types of income under the DTTs with the above jurisdictions and, the applicable MLI conditions: