What you need to know when working with the self-employed or 5 tax regimes for the self-employed

August 21, 2020

What you need to know when working with the self-employed or 5 tax regimes for the self-employed

Nowadays, there is a tendency that companies engage more freelancers for certain activity based on civil law contracts (CLC).

Advantages for companies working with the self-employed:

1) Reduced tax burden when working with the self-employed and exemption from tax administration;

2) No employment relations = No standard Employers’ liability such as employment administration (vacations, sick leaves, travel costs, compensation schemes, etc.);

3) The self-employed are personally liable for their health and safety in the process of performing work and providing services;

4) The self-employed are responsible for everything they require to perform the work (equipment, assets, PCs, etc.) independently;

5) Straight-forward termination of service contract in comparing with employment contracts, and many others.

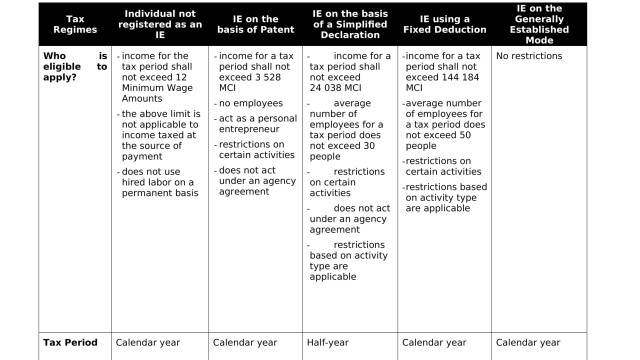

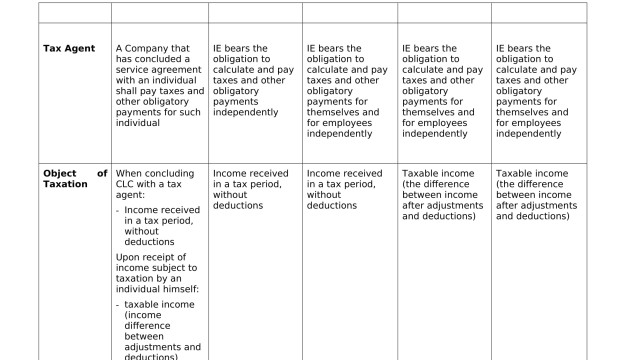

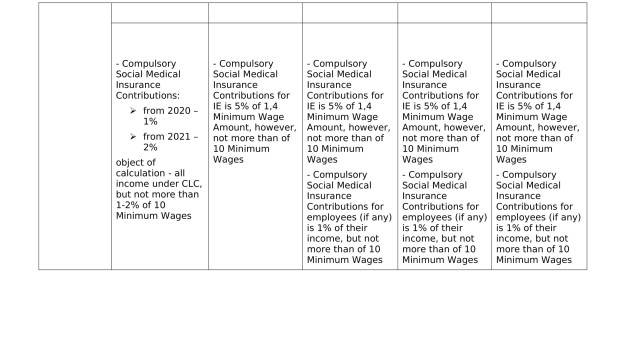

Thus, the advantages of engaging the self-employed are clear, however, tax clarity on this matter is very important, e.g. when and why the company should still act as a tax agent (withhold personal taxes), what restrictions, requirements and tax regimes are provided by the law for the self-employed, is it obligatory for all persons to register as an Individual Entrepreneur (IE)? The answers to these and other questions are provided in the summary table below.

Note: scope of this Article is to focus on tax implications when engaging the self-employed and we do not consider other areas of potential risks. For example, there is often risk of recognition of employment relations as opposed to independent service relations.

- - - - - -

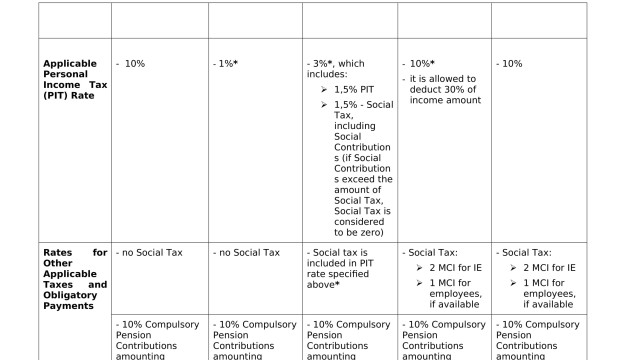

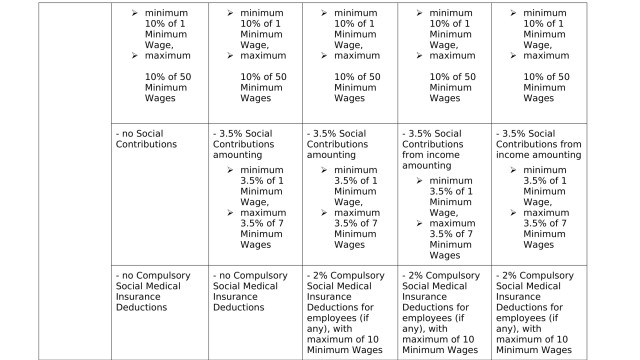

* Please note that for the period from 1 January 2020 to 1 January 2023, IEs working on the basis of Patent, of a Simplified Declaration and using a Fixed Deduction tax regimes are 100% exempt from paying income taxes.

Information contained in this Client Update is of general nature and cannot be used as legal advice or recommendation. Please note that Kazakhstan is an emerging economy, and its legislation and legal system are in constant development. Should you have any questions or want to discuss matters addressed in this Client Update, please contact us.