Tax Alert: May-June 2019

July 5, 2019

SIGNUM regularly provides Legislative Alerts to keep Clients informed about important legislation or regulatory changes in Kazakhstan. This Alert includes recent developments related to the following finance and tax matters:

E-Tax Invoices via ‘Virtual Warehouse’

Transition to Online-Cash Registers

The Rules of Issuing e-Tax Invoices

Draft Law On Ratification of the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent BEPS

Excise tax rates on petrol and diesel fuel

The investment project proposed for financing from non-state loans under state guarantees

e-Tax Invoices via ‘Virtual Warehouse’

The Order of the Kazakhstan Finance Ministry ‘On approval of the list of goods which e-tax invoices to be issued via ‘Virtual Warehouse’ of the Information System ‘e-Tax Invoice’ No. 284 dated 23 April 2019, came into force on 10 May 2019. The Order regulates all transactions starting from 1 January 2019.

The list of goods includes some commodities from the following groups of the EEU Unified Commodities Nomenclature:

Ground means of transportation, except for railway and trams, and their particles;

Sugar and sugar confectionery;

Nuclear-power reactors, boilers, technical and mechanical equipment, and their particles;

Electric cars and equipment, and their particles;

Audio, video, and their particles;

Optical, photo, cinematic, measuring, controlling, precision, medical and surgery instruments, and their particles.

For the full versions of the Order please email us at tax@signumlaw.com or follow the link.

Transition to Online-Cash Registers

On 1 April 2019, the Appendix 2 to the Order of the Kazakhstan Finance Ministry ‘On approval of the types of activities in the territory of Kazakhstan, which require the use of cash registers with the latching data functions and (or) transfer of data at cash transactions’ No. 206 dated 16 February 2018, came into effect.

The Appendix 2 includes 323 types of activities, e.g. rent of cars, rent of real estate, brokerage services, etc.

On a separate note, Appendices 3 and 4, which include 86 and 224 types of activities correspondingly, will come into effect on 1 July and 1 October.

For the full versions of the Order please email us at tax@signumlaw.com or follow the link.

The Rules of Issuing e-Tax Invoices

On 10 May 2019, the Order of the Kazakhstan Finance Minister ‘On approval of the Rules of issuing e-tax invoices in the Information System ‘e-Tax Invoice’ and of its form’ No. 370 dated 22 April 2019, came into force.

The Rules define the procedure of issuing tax invoices in electronic form in the Information System ‘e-Tax Invoice’ (hereinafter referred to as the ‘IS ‘e-Tax Invoice’), including the status of participants, procedure for registration of participants, procedure of issuing and signing of e-tax invoices, the features of issuing e-tax invoices at selling goods to individuals and at selling goods via ‘Virtual Warehouse’, at transfer of property to financial leasing.

The Rules are accompanied with the text of the agreement on use of IS ‘e-Tax Invoice’, where the participant accepts obligations to use the IS ‘e-Tax Invoice’, and the operator provides the participant with the access to IS ‘e-Tax Invoice’.

Moreover, the Order approves the form of e-tax invoice.

For the full versions of the Order please email us at tax@signumlaw.com or follow the link.

Draft Law On ratification of the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent BEPS

The draft Law of the RK ‘On ratification of the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent BEPS’ was sent to Majilis of Parliament of Kazakhstan. The MLI dated 24 November 2016, was signed by Kazakhstan on 25 June 2018.

The adoption of the MLI will prevent pulling out the income from country and coordinate the work on implementation of BEPS via multilateral negotiations of amendments to the existing double taxation treaties.

Kazakhstan is planning to spread the MLI to 37 double taxation treaties.

With the adoption of the MLI, for defining the tax regime in each case, it will be necessary to take into account provisions of national laws, double taxation treaties and MLI.

For the full versions of the draft law please email us at tax@signumlaw.com or follow the link.

Excise tax rates on petrol and diesel fuel

Starting from 1 June 2019, new excise rates on gasoline (excluding aviation fuel) and diesel fuel were introduced.

These changes are governed by the Decree of the Government of the Republic of Kazakhstan No. 331 dated 29 May 2019.

For the full version of the Decree please email us at tax@signumlaw.com or follow the link.

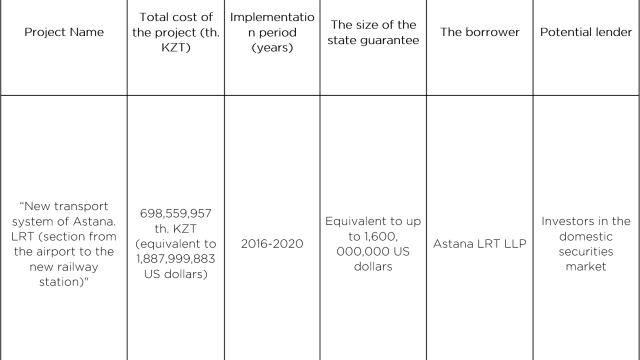

The investment project proposed for financing from non-state loans under state guarantees

The list of investment projects proposed for financing from non-state loans under state guarantees for 2019 was amended by the Resolution of the Government of the Republic of Kazakhstan No.363 dated 4 June 2019.

Thus, the aforementioned list was supplemented with the following project:

For the full version of the Resolution please email us at tax@signumlaw.com or follow the link.

The external links in this Alert referred to the web-sources in Russian language. Should you have any questions or require any further information please let us know.

Information contained in this Client Update is of general nature and cannot be used as legal advice or recommendation. Please note that Kazakhstan is an emerging economy, and its legislation and legal system are in constant development. Should you have any questions or want to discuss matters addressed in this Client Update, please contact us.