Kazakhstan Taxes. Introduction, 2022

July 14, 2022

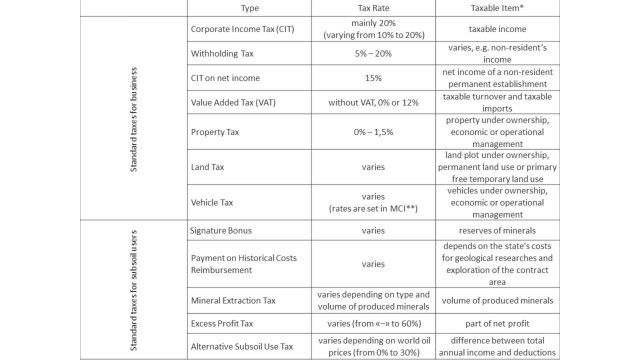

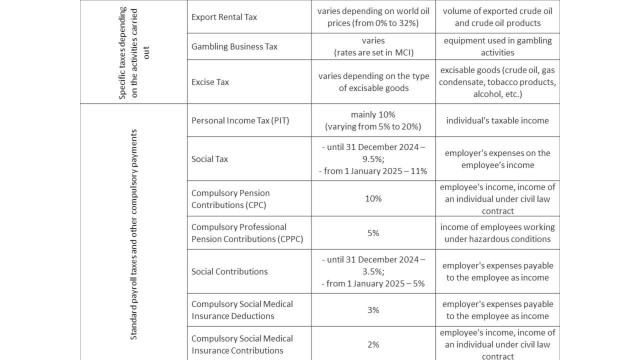

The following table is brief overview of the taxes and other obligatory duties payable in Kazakhstan. Hopefully, this summary would give initial understanding to foreign investors and entrepreneurs of taxation in Kazakhstan.

* Taxes and compulsory payments are payable by taxpayers holding the taxable items, specified rates are relevant for 2022 (with some exceptions).

** Minimum Calculation Index (MCI) in 2022 is 3 063 tenge. MCI in the amount of 3 180 tenge, set from 1 April 2022, does not apply to the calculation of taxes but only to the calculation of allowances and other social payments.[1]

Information contained in this Client Update is general and cannot be used as legal advice or recommendation. Please note that Kazakhstan is an emerging economy, and its legislation and legal system are in constant development. Should you have any questions or want to discuss matters addressed in this Client Update, please contact us

- Subparagraph 3) of Part 2 of Article 9 of the Law of the Republic of Kazakhstan “On the Budget of the Republic for 2022–2024”.