Taxes: What to expect after Kazakhstan signed MLI?

August 17, 2018

Lately, the international taxation laws have seen a trend for improvement. Various tax bodies of the states have been switching to a global yet flexible tax tool which aims at extending the uniform rules of taxation against the Base Erosion and Profit Shifting (BEPS).

The Organization for Economic Cooperation and Development (OECD) began elaboration of an action plan against BEPS as far back as 2013. Since then more than 100 jurisdictions have contributed to its implementation thereof. On 7 June 2017 more than 70 states witnessed the first official signing ceremony of the elaborated Multilateral Instrument (MLI) in Paris.

MLI is an instrument open for signature by any state, however it is cardinal to know that:

•\tIt implies a number of basic measures which are mandatory for all countries

•\tThere are also optional provisions, where the country can determine the scope of restrictions

Since the first signing in 2017, the MLI has already been signed by 82 states and 6 more jurisdictions have expressed their desire to join the instrument in the near future.

On 25 June 2018 Kazakhstan acceded by signing the MLI on the implementation of measures related to tax agreements, in order to counteract BEPS.

Why do competent bodies from around the globe seek for international interaction and how can MLI help counteract BEPS?

According to the OECD, the annual loss of corporate tax revenues around the world, is approx. USD 100-240 billion. In this regard, some major objectives of the instrument are:

•\tFair distribution of tax revenue

•\tActions against aggressive tax planning

The MLI, is an international treaty with a potentially universal impact on existing Double Taxation Agreements (DTA) and effective implementation of certain BEPS recommendations for:

•\tElimination of hybrid schemes to reduce the tax burden

•\tPrevention of abuse of tax agreements

•\tFeigned avoidance of the permanent representation status

•\tImprovement of the dispute resolution mechanism, etc.

This global instrument makes amends to the use of numerous, separate, legally unrelated international treaties. However, it does not replace the treaties nor does it constitute a protocol thereto, but, acts along the principle of ‘The later law abolishes the earlier one’. The instrument significantly changes the treaties via reservations and notifications mechanism. It is the flexibility of the instrument that seems to have furnished extensive support from jurisdictions with diverse levels of economic development and approaches to taxation. For instance, in order for a DTA between Kazakhstan and other jurisdictions to be amended in accordance with the MLI, such an agreement must be included in the list of agreements affected by the instrument by both jurisdictions – parties to the agreement.

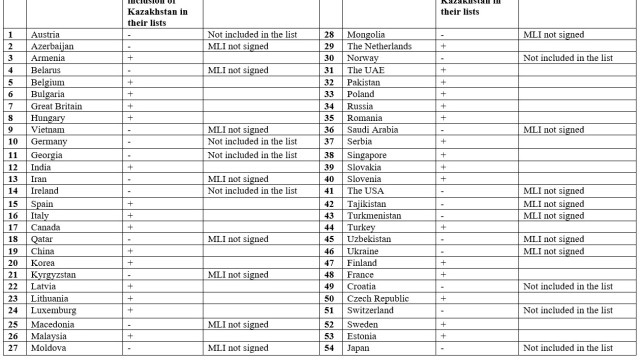

Kazakhstan lists 54 DTA, including those with Armenia, Austria, Belgium, Canada, China, India, Japan, Russia, Switzerland, and the USA. However, not all 54 countries have acceded to the MLI yet (i.e., the USA), and not all countries have indicated Kazakhstan as covered by the instrument (i.e., Switzerland). The below summary table gives an understanding of the matches with general information.

Further, the parties can make reservations concerning certain articles of the instruments, which conditions the application thereof to the respective agreements. For example, Kazakhstan made a reservation about the non-application of the third article of the instrument (‘Fiscally transparent entities’), this means the provisions of said article will not apply to the Kazakhstan residents. Kazakhstan is also reluctant to apply:

•\tThe fifth article ‘Application of methods for eliminating double taxation’

•\tThe eleventh article ‘Application of tax agreements in order to limit the rights of the Party concerning the taxation of its residents’

Therefore, the agreements with Kazakhstan will not contain corresponding provisions.

As a result, the application of MLI depends on the reservations and notifications made by both jurisdictions – parties to DTA. The official OECD website has an interactive beta version of the MLI compliance database for various countries.

Of course, one cannot rule out changes either by match or by further development of the MLI provisions. They can be modified or supplemented with protocols that are most likely to make amendments taking into account the practical application of the instrument, as well as potential supplements on the implementation of other BEPS measures.

When will the changes come into force?

The first changes to the covered agreements will come into force in early 2019. The timeframe for the entry into force depends on the completion of the ratification procedure in the states that are party to tax agreements under MLI. Signing parties will inform OECD of the completion of ratification procedures.

It is important to note that the OECD also plans to monitor the amendments to the DTA. According to the OECD plan, countries must report on the work on the amendments to the DTA, at least, concerning the ‘minimum standard’. The OECD has already started their checks from 2018 onwards. The monitoring will be carried out annually, with the publication of an annual report on the introduction of standards (the first report is planned to be published in 2019) and analysis of the impact of the amendments to the MLI on each DTA.

At the same time, monitoring will be carried out not only with regard to the states that have acceded to the instrument, but also other countries through analysis of the DTA provisions and identification of compliance with the minimum standard.

What does this imply for taxpayers?

The Instrument is an extremely flexible document, the application of many provisions of which is conditioned by the will of the DTA jurisdictions. In order to properly apply the DTA provisions in terms of the convention, taxpayers must refer to 4 documents:

•\tDTA

•\tMLI

•\tPosition of the first jurisdiction

•\tPosition of the second jurisdiction

In future, jurisdictions, whose agreements will be changed by the instrument, will draft consolidated texts for the sake of convenience.

OECD; in view of the growth of the analytical burden; will also elaborate and publish on its official website the manuals and tools for the MLI application. On top of that, there will be a separate explanatory note that describes the mechanism of the instrument which will facilitate the interpretation of certain norms.

Currently, we recommend that companies hold a careful analysis of how MLI may affect existing and planned processes and structures with regard to the economic content. One should not rely on formal indexes to avoid taxation. New instruments against BEPS will allow tax bodies to easily detect the presence of the economic content of the structure, regardless of its formal characteristics.

Hence, even before the formal entry into force of the instrument and amendment of the relevant DTA provisions, all taxpayers should now take into account the MLI rules when structuring business to exclude or at least reduce the risk of claims from tax bodies.

On our part, we will be happy to comprehensively assist our clients with the above issues and analyze possible risks associated with the ratification of MLI and the use of other BEPS tools, as well as provide recommendations for avoiding or minimizing such risks.